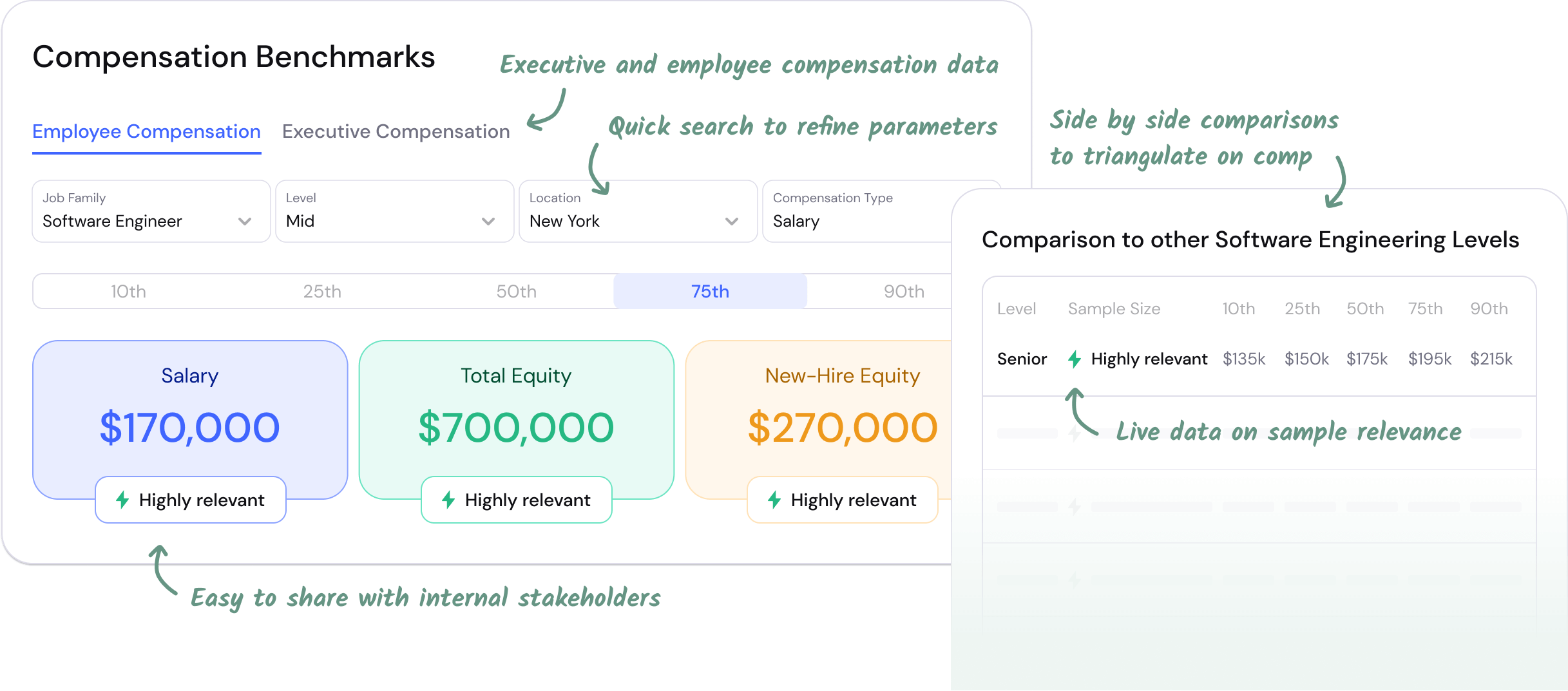

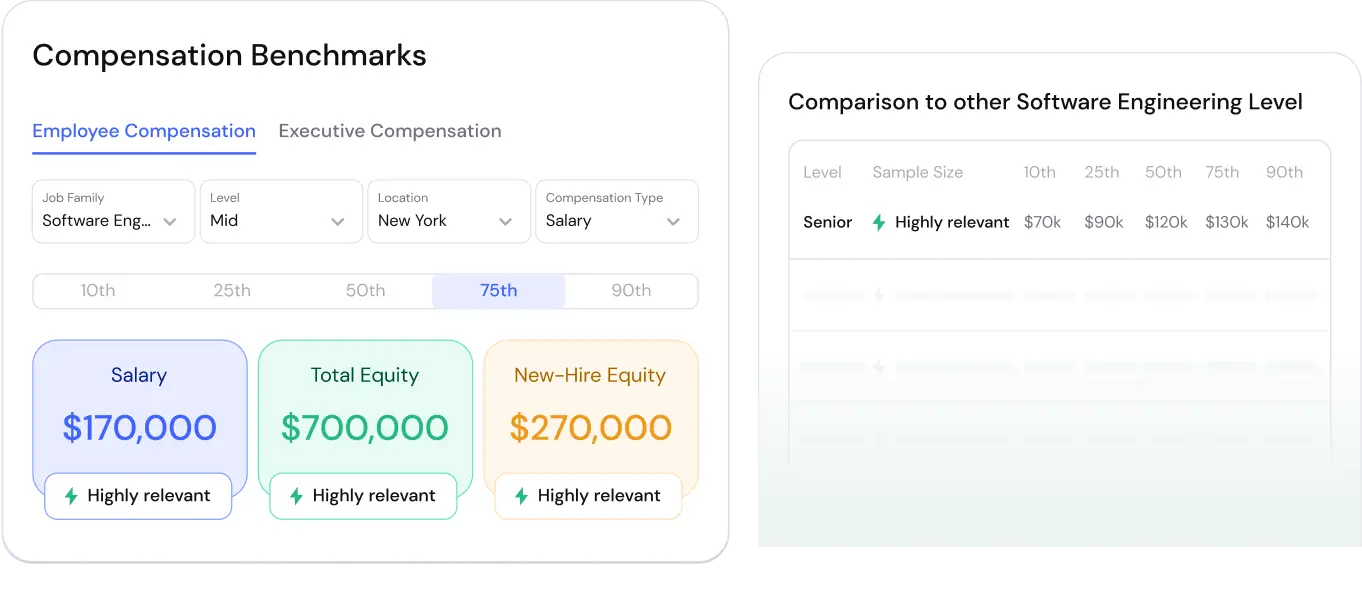

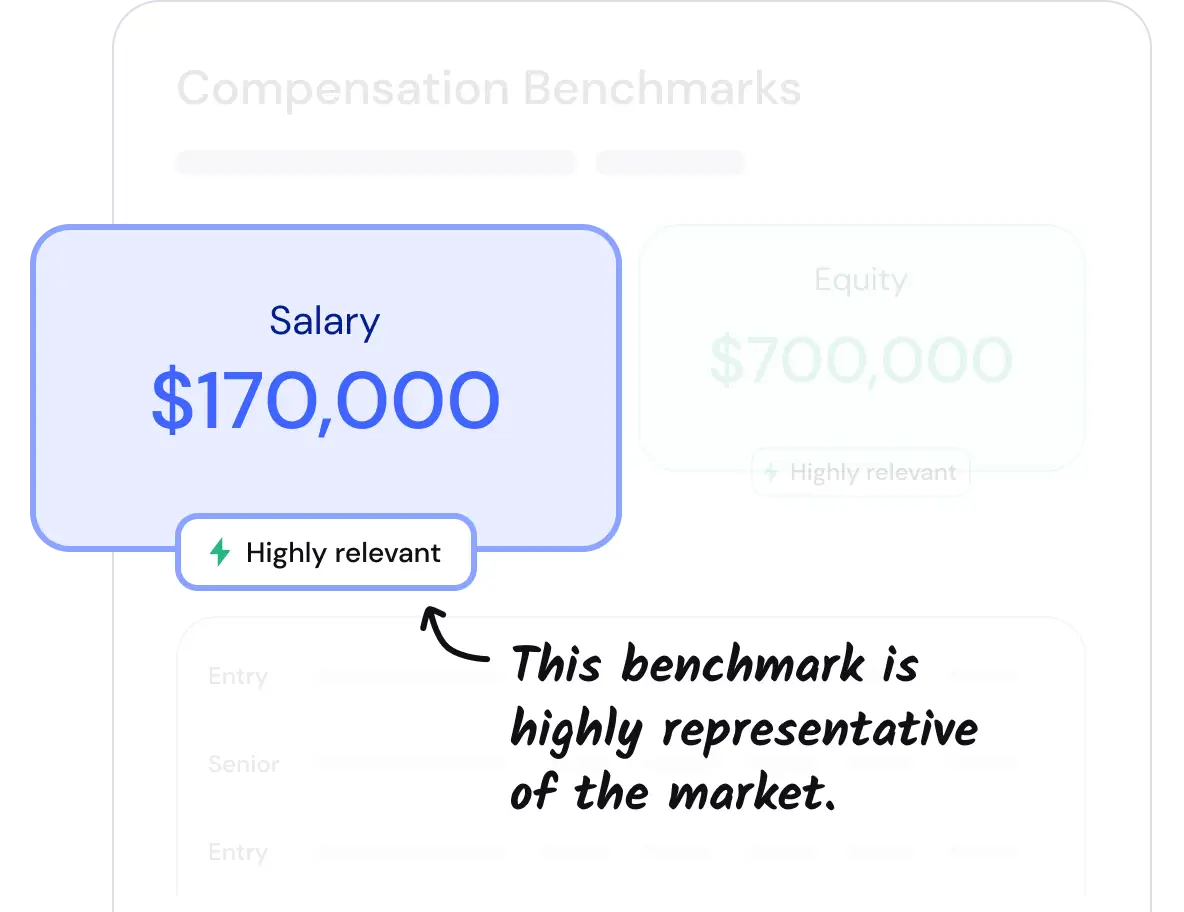

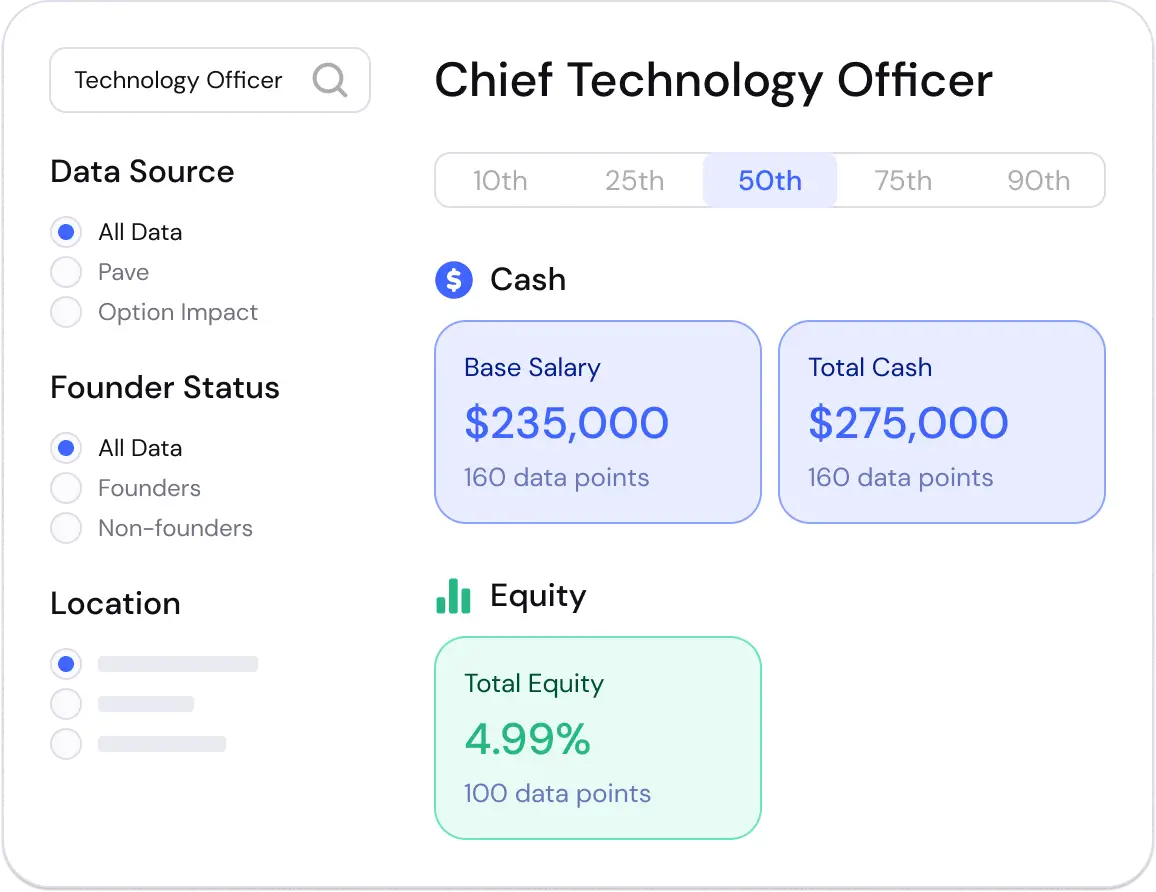

Inspire confidence with real-time benchmarks

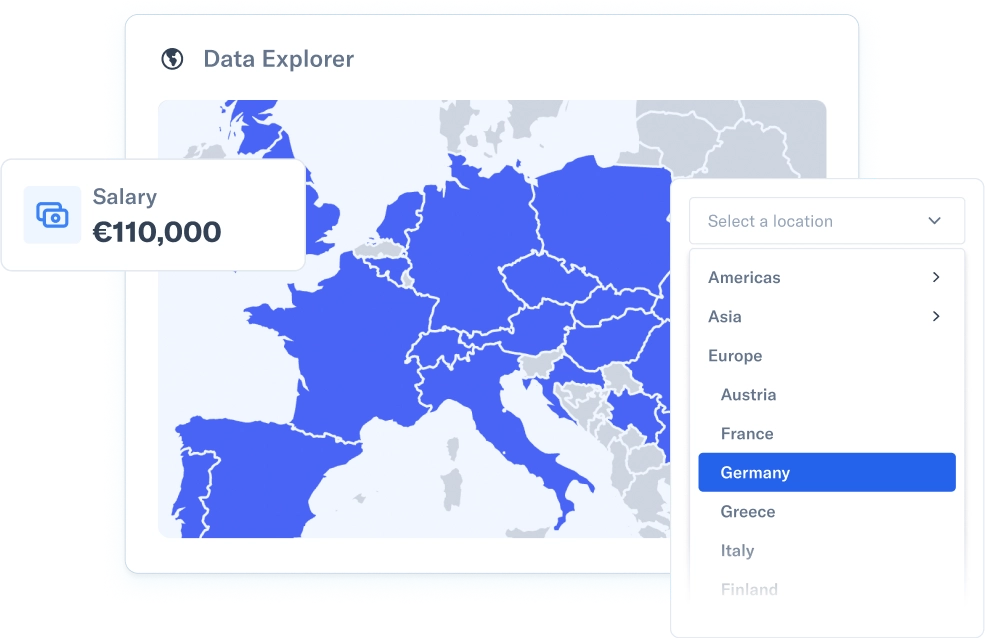

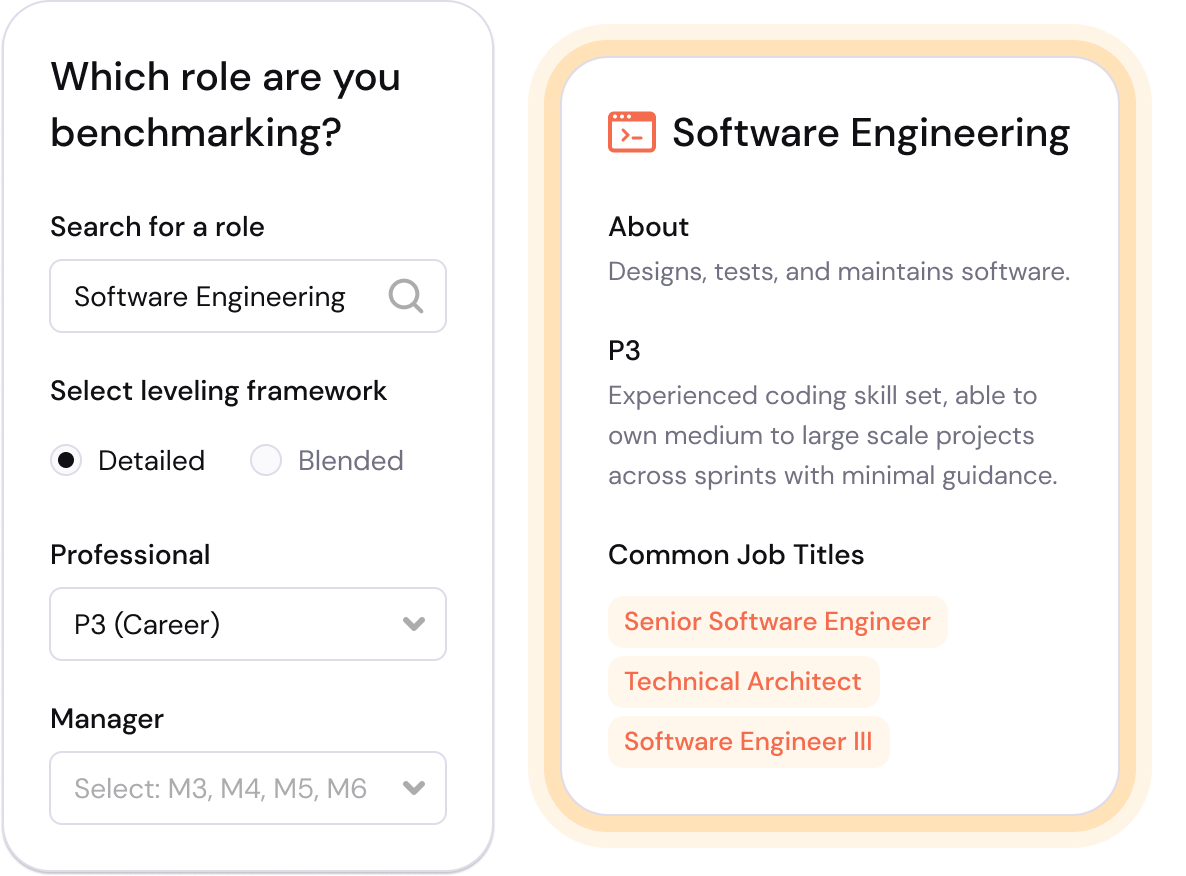

Outdated survey data is a thing of the past. Unlock salary and equity data you can't get anywhere else. Simply connect your HRIS and equity management systems to access real-time compensation benchmarks from over 7,500 top companies.

Sign up for free